Kelly Criterion Formula For Excel Download

Kelly Criterion Formula For Excel Download. For this investment, w is 60% and r is 1 (20%/20%). / downloads / kelly criteria spreadsheet.

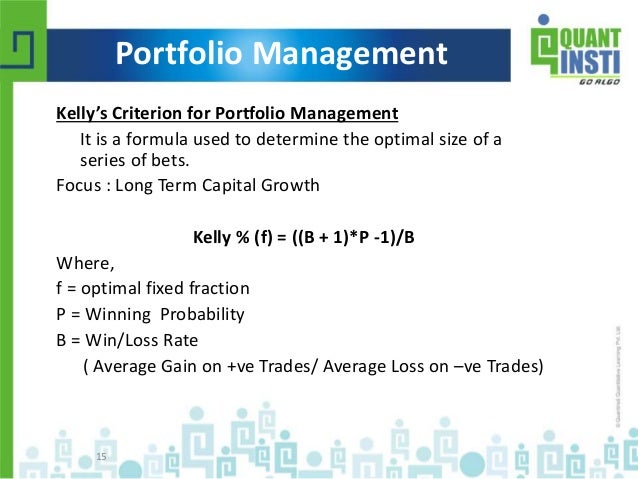

In probability theory, the kelly criterion (or kelly strategy or kelly bet), is a formula that determines the optimal theoretical size for a bet. The kelly criterion is a formula used to bet a preset fraction of an account. The spreadsheet compares your betting performance to the hypothetical results had you strictly followed the four staking plans.

* W = Historical Winning Percentage Of A Trading System.

Simply input your betting bankroll, the odds on offer, your assessed probability for that outcome occurring and your kelly fraction. The kelly criterion is a staking plan that uses a mathematical formula to seek out opportunities for profitable bets. W = historical winning percentage of a trading system.

For This Investment, W Is 60% And R Is 1 (20%/20%).

After applying the fractional kelly value of 0.04, this adjusts to a wager of approximately 1.71 % of your account balance. Google kelly criterion formula for excel and you will see several hits with free excel file downloads. Grazie ad una formula riusciremo quanta quota del capitale.

R = Historical Average Win/Loss Ratio.

What i need is if he wins and say i bet $5 on him, how would i. Unlike our standard excel betting tracker, this worksheet calculates recommended stakes using four different staking plans: Joined sep 27, 2003 messages 453.

So Why Doesn’t Every Money Manager Follow This Simple Formula?

It can seem counterintuitive in real time. Works best when used in retrospect. However, unlike in the previous situation we examined the kelly criterion for, there is not a nite number of outcomes of a bet on a security, so, we will use

In Probability Theory, The Kelly Criterion (Or Kelly Strategy Or Kelly Bet), Is A Formula That Determines The Optimal Theoretical Size For A Bet.

The data included are the spy etf historical prices as well as the backtest results from the london breakout strategy applied to the eurusd. If you have an 80% chance of winning $21 on a $1 bet, and 10% of winning $7.50, that's equivalent to having a 90% chance of winning $17.55, which is 18.55:1 expressed in bookie odds. Kelly % = percentage of capital to be put into a single trade.

Posting Komentar untuk "Kelly Criterion Formula For Excel Download"